Governments around the world are set to tender more than 60GW of offshore wind capacity in 2024, of which around two-thirds (40GW) is in Europe.

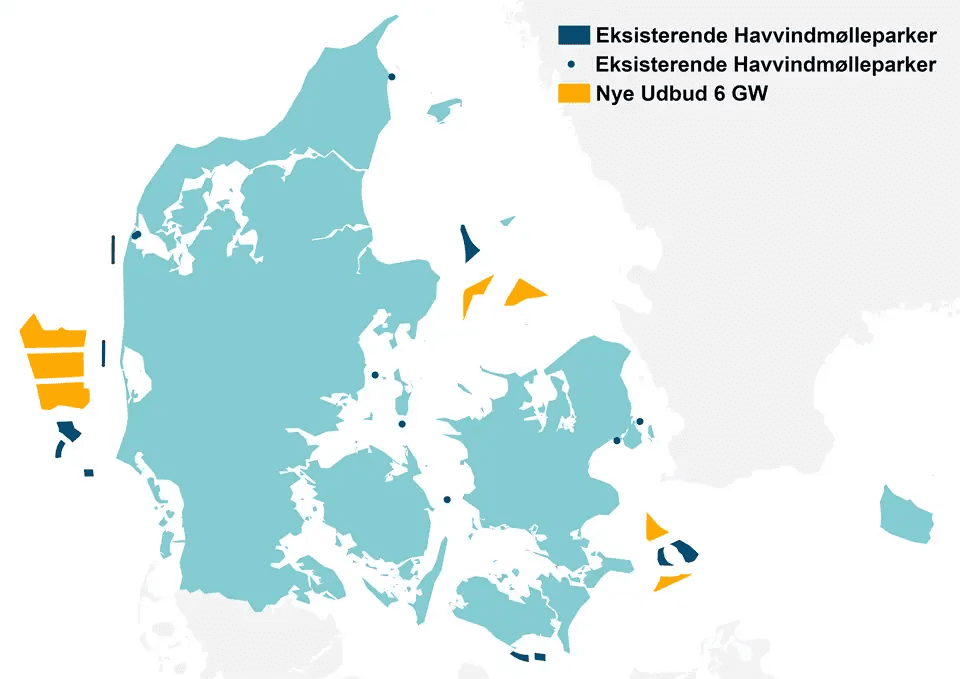

In April, the Danish Energy Agency started its tender for six sites with up to 10GW of offshore wind capacity, which is Denmark’s biggest offshore wind tender so far. This follows Norway’s 1.5GW Sørlige Nordsjø tender that concluded in March. And in the Netherlands, we expect the 4GW IJmuiden Ver tender to concluded in June.

A map overview of the 10GW included in Denmark’s largest offshore wind tender so far. Source: Danish Energy Agency

We are also expecting huge tenders this year in countries including Germany (8GW) and France (2.5GW), while the UK’s sixth Contracts for Difference allocation round is well underway. The latter tender will be particularly interesting as the UK attracted no bids for offshore wind farms in its fifth CfD tender round last September, following the inflation and supply chain disruption seen in the industry in the last 18 months.

But while that tender was branded a ‘failure’ in the media, many in the industry saw it as a positive. They argued that it showed offshore wind developers were prioritising the viability of their projects in their tender bids, rather than submitting a bid that was too low to profitably build the project. Financial viability instead of growth at any cost.

We have seen in 2024 that this was not a one off. In Sørlige Nordsjø, we saw two of the five pre-qualified bidders decline to bid due to concerns about the structure of the tender, and some experts expect to see similar in Denmark. Meanwhile, in Lithuania, the government last month delayed a 700MW tender after only attracting one bidder.

These show developers are prioritising the deliverability of offshore wind projects in the design phase before they submit tender bids – but the concerns about viability don’t end there. After winning a tender, developers still need to take their scheme to financial close and then into construction. During this execution phase, projects are still subject to changes due to potential delays in the supply chain, vessel availability and the global market conditions in general

This is forcing developers to keep their projects’ business cases under constant review, and is an area where digital project simulation and optimisation technology can provide essential insights.

Rolling simulations to support wind project viability

The offshore wind sector now is fundamentally different to how it was a decade ago.

Back then, projects were heavily subsidised by governments, and developers could manage projects on Excel spreadsheets and own in-house developed tools knowing they were likely to make healthy profits even with this fairly inefficient approach.

That is no longer the case and should force developers to think seriously about how they use digital simulation and optimisation software to manage projects. The move to tenders means we are all now in an era of extreme competition, even if some developers are avoiding some tenders when they feel they cannot submit a viable projects. Profit margins are still slim following the ‘race to the bottom’ on cost we’ve seen over the last decade, and so there continues to be major pressure throughout the supply chain.

In addition, there are maybe 60-70 companies and consortia who now bid in various offshore wind tender processes in the North Sea, compared to between five and ten established players that we had a decade ago. In this competitive environment, bids must be watertight to avoid costly mistakes and projects must be kept under review.

Increasingly, we see that developers need time series based weather dependent simulations to accurately assess the performance of projects. These simulations need to include reference to a host of dynamic real-world factors, from various turbine and foundation types and locations to the availability of vessels, ports, potential weather delays, and so on. Such simulations help developers design projects in the early stages, and also respond to changes throughout construction.

We should not underestimate the scale of this challenge as offshore wind becomes more global and developers are exposed to new risks. Companies may know what it takes to build a wind farm in the North Sea, where there is a wealth of experience in the industry, but what about when they want to get steel in the water in Asia, North America, South America or Australia? They will need accurate simulations that take into account then dynamics of these markets and help them take the right decisions.

For example, most of our customers continue using our design simulation solution into the constructing phase. Why? Because the tender win is not the end. If they want to take a project successfully through construction and into operation then they need to simulate, monitor and adjust progress on an ongoing basis to ensure full control of the project

The industry is moving fast, but the focus on making – or keeping – a project viable will remain.

To find out more about how our digital simulations and wider product suite can help you with your projects, please contact our team