The winds of change are blowing along the United States East Coast, signalling a monumental shift in the approach to offshore wind energy. The US East Coast has an incredible pipeline of work for offshore wind over the coming few years, with c. 24 GW of wind turbine capacity due to be installed between 2024-2030. The Biden-Harris administration has targeted 30 GW of installed capacity to be available by 2030.

The winds of change are particularly highlighted by newly accelerated Power Purchase Agreement (PPA) auctions with an emphasis on recovery from recent disruptions, underscoring the industry’s resilience and commitment to progress. New Jersey is leading the charge, initiating its fourth offshore wind solicitation in early 2024. This move expedites the state’s ambitious goal of achieving 11 gigawatts by 2040. Simultaneously, New York and the New York State Energy Research and Development Authority (NYSERDA) are gearing up for expedited solicitations aligned with New York’s 10-Point Action Plan. Proposals for these projects are due by January 25, 2024, with award announcements anticipated in February 2024.

However, to deliver this pipeline, this new American offshore industry faces some major obstacles, namely the shortage of American-built, -crewed and -flagged wind turbine installation vessels (WTIVs) which fulfil the requirements of the Jones Act. Indeed, only one suitable vessel is in construction, Dominion Wind’s Charybdis, but on its own it cannot fulfil the significant upcoming demand.

This shortage comes at a time when the U.S. is fervently embracing offshore wind as a key component of its renewable energy strategy. The industry is grappling with the task of swiftly ramping up infrastructure to meet the ambitious targets set by the administration. The urgency to fill this gap and overcome logistical challenges has become even more pronounced given recent announcements highlighting the United States’ commitment to becoming a global leader in offshore wind.

Feeder-based installation is key to US offshore wind deployment

Central to this growth is the approach of feeder-based offshore wind installations. This solution not only aids developers in navigating Jones Act restrictions and diminishing dependence on foreign ports but also enables the deployment of next-generation turbines using existing Wind Turbine Installation Vessels (WTIVs).

The industry-agreed method is to use overseas wind turbine installation vessels for the actual installation, but since these cannot dock and load out components, the components need to be transferred to the installation site by feeder barge or feeder vessel adhering to the Jones Act requirements. Typically it would make sense for the feeder vessel to load out the components onto the WTIV, and then sail back to the marshalling port to re-load, but some new vessels can be docked within or alongside the WTIV, which installs from the feeder.

To our knowledge, there are only two sites which have experimented with the feeder installation method to date, and both of these are off the coast of Massachusetts: Vineyard Wind 1 and South Fork. Unloading components from feeders to WTIVs can be especially challenging in turbulent seas. The need to model some of this complexity and risk is thus paramount to ensure that submitted bids are as realistic as possible.

De-risking feeder installation scenarios for offshore wind

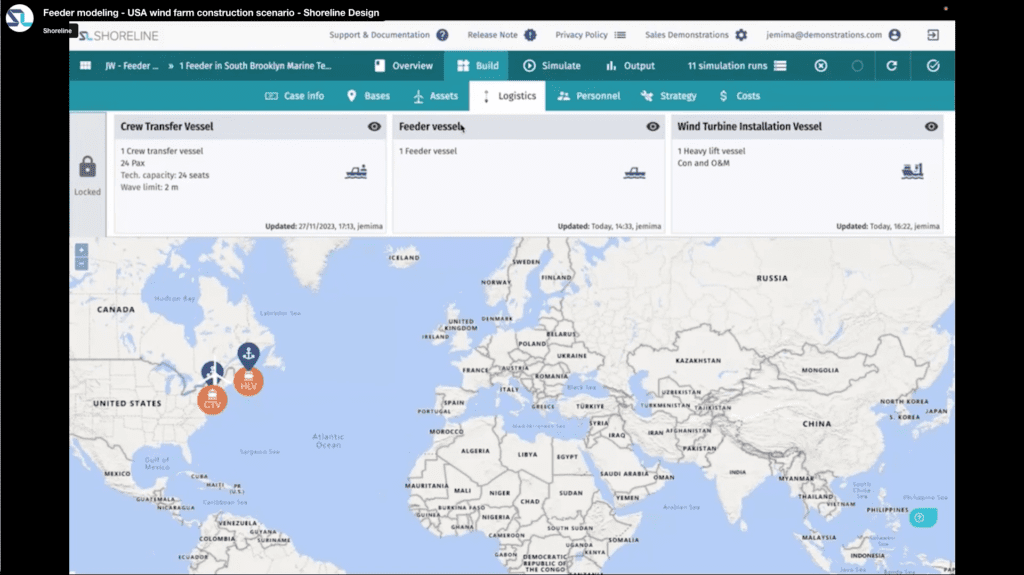

Enter Shoreline Wind’s Design solution, a crucial tool in navigating the complexities of offshore wind projects. Since 2017, it has stood as the go-to platform for wind farm planning and simulation, offering a dynamic solution for developers, OEMs, and other stakeholders. This tool proves to be far more efficient than traditional methods like Excel spreadsheets, aiding in identifying and resolving potential project risks.

The software has been equipped with feeder modelling capabilities for several years, allowing users to simulate various feeder-based installation scenarios. This functionality enables stakeholders to compare completion times and assess the impact of weather downtime, providing a comprehensive view of the project landscape.

Shoreline Design tackles critical questions for de-risking offshore wind projects:

1. Impact of Home Port: How will the home port of the WTIV affect my project timeline and overall completion date?

2. Optimal Marshalling Port: Which port is best suited to being the marshalling port, bearing in mind port capacity limitations, distance from install site etc.?

3. Feeder Vessels/Barges Optimization: How many feeder vessels / barges would be optimal?

4. Vessel/Barge Model Selection: Which feeder vessel / barge models would make sense for my project, taking into account parameters such as wave height restrictions, motion compensation functionality etc.

5. Weather Impact Analysis: How will weather impact my project installation?

A short video demonstrates how Shoreline Design models feeder-based installations, giving a quick look at how it helps plan more cost-efficient offshore wind projects on the East Coast.

Looking ahead, the future of the U.S. offshore wind market holds promise and challenges. With the acceleration of PPA auctions and states like New Jersey and New York setting ambitious goals, the market is making critical moves for substantial growth. The increased focus on expediting solicitations and the involvement of key players indicate a maturing industry ready to play a crucial role in the nation’s energy landscape.

However, the shortage of American-built installation vessels remains a hurdle, demanding strategic investments and innovations to meet the escalating demand. The industry’s response to this challenge will likely shape the trajectory of offshore wind development in the U.S. in the coming years.

As the U.S. East Coast embarks on the transformative journey towards a renewable energy future, Shoreline Design stands out as a business-critical digital support for wind energy, not only for planning and simulation but also for de-risking and optimizing offshore wind projects. Its ability to model feeder-based installations becomes increasingly relevant as the industry navigates the evolving landscape shaped by recent commitments, policies, and developments in the offshore wind sector. The future outlook is one of both challenges and opportunities, where the collaborative efforts of industry stakeholders will play a pivotal role in shaping a sustainable and thriving offshore wind market in the United States.