Designing and delivering offshore wind farms has never been more complex.

The industry has made its way out of the start-up phase. Almost 11GW of offshore wind farms were commissioned in 2023 to take global capacity to over 75GW, according to the Global Wind Energy Council. Now the sector is in its scale-up phase, with a further 138GW set to be delivered between 2024 and 2028 alone – or 27.6GW on average each year.

But companies through the offshore wind supply chain face a host of challenges, such as the impacts of inflation, disruption and supply gaps on projects with slim profit margins. These attracted huge discussion and led to high-profile project delays in the UK and US.

These challenges hamper the ability of EPCI contractors to efficiently plan transportation and installation (T&I) strategies that maximise profitability of projects. Many companies suffer due to lack of clarity over the impact of potential supply chain bottlenecks; evolving developer strategies for tendering and contracting at projects; the difficulty of estimating power production losses from cable and other failures; and rising raw material costs.

However, on 26th November, Shoreline’s chief product officer Ole-Erik Endrerud talked about digital approaches that could help EPCI contractors in a webinar called ‘Powering the wind energy lifecycle’, and the importance of accurate modelling to cover aspects of the life cycle including component assembly, transfers and offshore installations.

He said: “We see all the challenges out there for how do you analyze more complex scenarios? We came from trying to replace an Excel-driven world using simulations and optimizations to do more detailed, more precise analysis.”

International coordination

A core challenge for EPCI contractors is how to coordinate supply chain partners with operations in many countries: “How do we build out scenarios for T&I in there with now a deeper level of complexity?” asked Ole-Erik.

For example, in Europe, turbine components may come from suppliers in two or more countries; be assembled as turbines in a third; and then installed on-site somewhere else entirely. But the right digital tools can help companies to model the movements of components and the availability of ports, while taking into account potential disruptions such as a shortage of vessels, industry skills gaps and periods of bad weather.

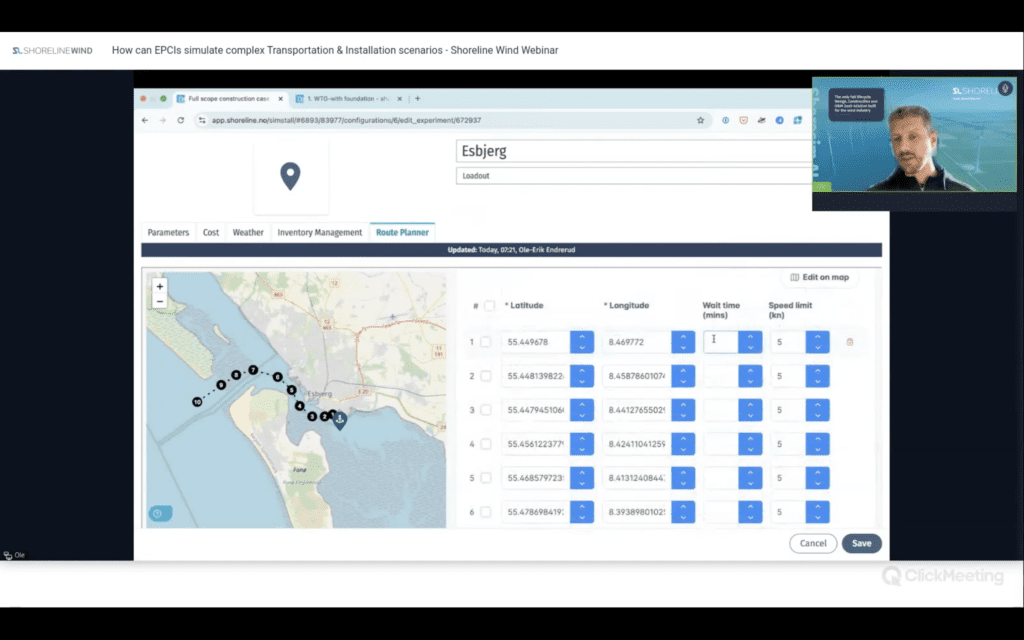

He shared a theoretical example of how Shoreline could help develop these T&I plans: “In this case, we get foundations and towers from Ferrol in Spain, with blades coming from Hull. We have Esbjerg as our marshalling, loadout and pre-assembly harbour; and Cuxhaven for the nacelles. We have transportation of components between locations from fabrication yards to Esbjerg; we have installation vessels in Esbjerg doing the job of installing actual assets offshore, both foundations and turbines. We have pre-assembly in this port, and we have vessels with commissioning personnel to commission turbines to get them started offshore,” he said.

It is a complex environment where the right information and insights are vital. You can watch the webinar for the full discussion of the risks and opportunities.

Screenshot from the webinar “How EPCI contractors can optimize offshore wind transportation and installation (T&I) strategies”

In short, though, we support companies with a platform that uses artificial intelligence to model a wide range of scenarios, to identify and avoid potential problems that reduce project profits and lead to delays. These simulations use a wide range of inputs, such as date and time restrictions; modelling for relationships and dependencies between different steps in the T&I process; limited weather windows; and inventory management.

Key steps to optimal T&I plans for EPCIs

Ole-Erik explained that companies can start to develop these plans by inputting granular details about their project plans in our Design product to create accurate simulations.

“You can model every single thing that needs to happen to this asset to make it all the way from the factory door to pre-assembly, to installation, to commissioning, and so on. You can model all of that,” he said.

This includes the ability for EPCI contractors to specify whether they will follow a shuttle-based installation programmes, which is when the installation vessel handles both the transportation and installation of components; or a feeder-based installation programme, when vessels primarily move components to other vessels that carry out the installation. Each carries different risks of delays and cost impacts, so must be considered individually.

After inputting this data, EPCI contractors can accurately simulate their T&I and O&M strategies within around five minutes each and generate full project plans within an hour.

As well as developing plans up-front, companies can also edit the plan in real time based on changes that arise and gain insights about how work is actually progressing on-site.

“We estimate the time of construction including all the stuff we’ve done. How much we’ve used our vessels, how many days they’ve been offshore, and we can estimate a progress curve for every single one of the different tasks we’ve defined,” he said. This enables firms to accurately predict how long each phase will take and then track progress on site.

This provides companies with estimates about when different jobs are likely to complete onshore and offshore; and then analyze projects to assess based on key criteria, from the utilization of vessels and workers to the impact of weather disruption on the plan.

“You can go and see specifically all of the weather downtime this vessel had, what’s the split between the different reasons for it, and the root cause for exactly why we didn’t do work,” he said. “It gives you a detailed view of where you need to optimize. You can see the different risk levels to see why projects might end up being delayed.”

Finally, he said Shoreline is looking to add features, including insights that let companies see the potential impact of poor weather conditions along their planned vessel routes, to increase the accuracy of the simulations: “We are constantly developing based on the needs from developers, operators, OEMs and also EPCIs that use our products day to day,” he said.

As the offshore wind industry gets busier and projects get larger and more complex, this is data that can help EPCI contractors and their partners to thrive.

Webinar: How can EPCIs simulate complex Transportation & Installation scenarios